AI Banking Video Analytics to Improve Branch Security, Compliance and Customer Experience

- 99.98% Camera Uptime

- < 10s Incident Response Time

- > 65% Improvement in SOP Compliance

- 80% Reduction in Security Incidents

Trusted By Leading Brands

Video Analytics Makes Your Bank Branches & ATMs Smart!

Use Cases

Case Study: Automating Security for 26,000 ATMs with AI Banking Video Analytics

Problem

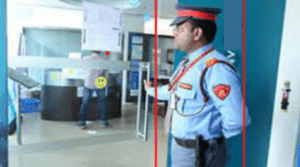

According to the report of the Finance Ministry, there are 2.13 lakh ATMs and innumerable bank branches as of 2024. Security of ATMs and banks is a supremely vulnerable industry in India. There is an ATM in almost every corner of the street in a city in our country but security and maintenance continue to be considerable issues.

A nationwide ATM-security provider relied on a 24 × 7 command-centre staffed by dozens of CCTV operators. Each operator had to watch multiple camera feeds and manually flag threats such as:

More than three people crowding an ATM booth

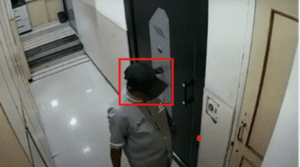

Customers entering with face masks or motor-bike helmets

Slip-and-fall incidents

Weapon flashes during attempted robbery

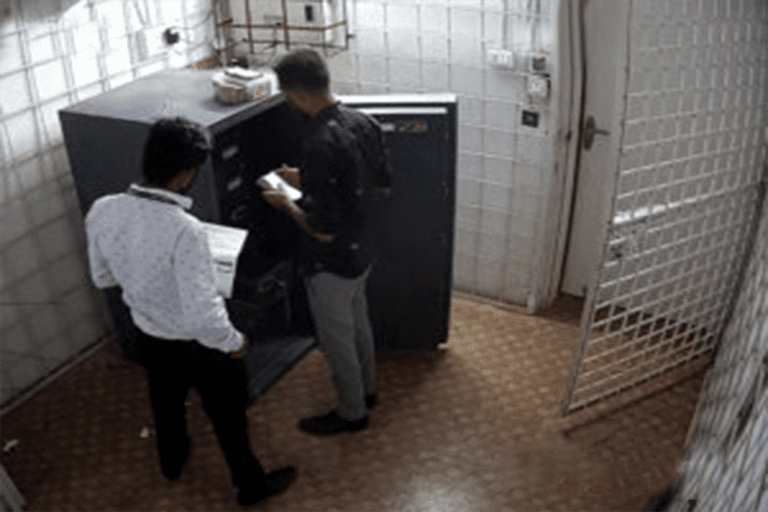

Tampering with card reader, keypad, or cash chest/hood doors

Operator fatigue led to missed events, and incident response times often exceeded 40 seconds—long enough for thieves to force a cash-out or escape unnoticed. Rising labour costs and regulator pressure to tighten SLA windows pushed the company to seek an automated alternative.

Solution

The firm rolled out Agrex.ai Banking Video-Analytics Suite across 26 000 ATMs without replacing a single camera. Key modules included:

Smart Occupancy & PPE Detection – instant alerts when > 3 people, masked faces, or helmets are detected inside the kiosk.

Fall & Weapon Detection – edge AI models trigger alarms within 300 ms of a fall or weapon appearance.

ATM Integrity Monitoring – real-time recognition of chest-door or hood-door openings outside authorised maintenance windows.

Rule-based Alert Router – pushes high-confidence events to the SOC, local police, and the bank’s mobile-response team simultaneously.

Analytics Dashboard – SLA timers, false-alert heatmaps, and operator performance KPIs visible to management.

All alerts stream through a secure API into the existing VMS, so staff workflows stayed intact.

Outcome

In just 90 days, the operator saw measurable, cross-functional improvements:

Metric | Before AI | After AI | Delta |

|---|---|---|---|

Average incident response | 42 s | < 5 s | -88 % |

Full-time CCTV operators | 118 | 34 | -71 % FTE |

Monthly false alarms | 8,200 | 750 | -76 % |

Confirmed tamper / robbery losses | 11 / quarter | 4 / quarter | -64 % |

Additional benefits:

Regulator SLA compliance improved to 99.5 % (RBI guideline ≥ 95 %).

Customer trust scores (post-ATM survey NPS) rose 14 points.

SOC staff now focus on multi-site coordination instead of “screen staring.”

Ready to modernise your ATM or branch security?

Book a live demo of Agrex.ai’s Banking Video Analytics and see how you can cut risk, cost, and response times—using the cameras you already own.

Learn more about our offerings in other industries:

Check ATM functioning

- If the machine is working or not.

- If the shutter is down.

- Keep a check on camera tampering.

Ensure safety and security

- Look over the presence of multiple people.

- Keep a check on wearing face mask

- Automated alarms on security absence

- Detecting any type of violence, burglary, or shoplifting

Improve Cleaning operations

- Maintain a check on the cleanliness.

- A check on any other SOP