Smarter Banking Video Analytics for ATMs & Branch Operations

How Banks Use Video Analytics to Enforce SOPs Instantly

Executive Summary

In an era defined by accelerating digital transformation and an ever-evolving threat landscape, a leading Indian bank successfully redefined its operational and security posture by implementing a real-time video analytics solution. The initiative targeted a fundamental shift from a reactive, human-centric surveillance model to an automated, data-driven one. By converting existing CCTV camera feeds into actionable intelligence, the bank was able to address key challenges across its physical network, including inconsistent SOP compliance, unmanaged customer wait times, and a rise in sophisticated suspicious activities at ATMs and branches. This strategic pivot to a proactive operational paradigm resulted in a dramatic improvement in operational efficiency, a significant reduction in risk exposure, and a measurable uplift in customer satisfaction—all while creating a verifiable, regulator-ready audit trail for every incident.

This case study details the bank’s journey, highlighting the critical role of video analytics in modern finance. It showcases how a strategic partnership with an innovative technology provider can unlock unprecedented value from a bank’s physical assets, securing its future in a highly competitive market.

Market Trends & Context: The Forces Driving a Paradigm Shift

The banking industry is currently navigating a complex environment shaped by several converging trends that underscore the urgent need for intelligent, automated solutions in physical locations.

The Enduring Importance of the Physical Branch: While digital banking has exploded, the physical branch remains a cornerstone of customer trust and engagement. Recent studies consistently show that 82% of customers say their local branch is still important for building trust and resolving key transactions. This puts pressure on banks to ensure their physical spaces are not just secure, but also operate with peak efficiency to justify their existence in the digital age.

The Rising Tide of Financial Fraud and Suspicious Activities: The threat landscape is evolving rapidly. RBI data for FY25 shows a threefold jump in fraud value to ₹36,014 crore, despite fewer overall cases.: while the number of fraud cases may be decreasing, the total value of fraud is sharply increasing. This indicates that criminals are executing fewer, but larger, high-value attacks. This reality reinforces the need for preventive, real-time security controls that can detect and neutralize suspicious activities before they result in significant financial loss.

Customer Experience as a Competitive Differentiator: In a crowded market, customer experience is a key driver of loyalty and brand perception. Long queues and unpredictable wait times are a major source of customer frustration and a leading cause of churn. The ability to manage customer flow and provide a seamless, efficient in-branch experience is no longer a luxury—it is a critical lever for attracting and retaining clients.

The Dawn of Video as a Data Source: Global video analytics is expanding at a CAGR of ~22%, driven by AI/edge computing that allows real-time alerts at scale without massive infrastructure overhauls. Businesses across industries are moving beyond passive video surveillance and are beginning to unlock the rich, real-time data embedded in their video feeds. This shift from “surveillance to intelligence” offers a massive opportunity for the banking sector to optimize operations and secure assets in ways previously impossible.

The Challenges: A Reliance on Reactive & Manual Processes

Before this initiative, the bank’s operational and security posture was hampered by a heavy reliance on manual processes and a reactive approach to problem-solving. These were the primary challenges:

Inconsistent SOP Adherence & Reputational Risk: Enforcing standard operating procedures like on-time opening and closing across hundreds of locations was a manual, resource-intensive task. The bank lacked a verifiable audit trail, leading to inconsistent customer experiences and a compliance risk with regulators like the RBI, which emphasizes predictable service.

Inefficient Queue Management & Customer Dissatisfaction: Branch managers lacked real-time insight into customer flow and wait times. This resulted in long queues during peak hours, which directly lowered customer satisfaction scores and led to inefficient staff allocation.

Procedural Security Gaps: The bank relied on human oversight for critical procedures at teller counters and ATMs. This created a significant window of opportunity for internal and external threats, as procedural breaches were often discovered only after an incident had occurred.

Reactive Security Posture: The existing CCTV network served primarily as a forensic tool. Security teams could only review footage after an incident had occurred, rather than using the system to prevent suspicious activities from happening in the first place.

Fragmented Data & Ineffective Auditing: Incident reporting was a siloed process, disconnected from video evidence. This fragmented data made it difficult and time-consuming to conduct efficient internal audits and trace the root cause of issues.

The Agrex.ai Solution: Proactive Banking Video Analytics

Agrex.ai offers a transformative banking video analytics platform that turns passive CCTV systems into a powerful source of real-time intelligence. Our solution is designed for seamless integration with your existing infrastructure, ensuring a fast, cost-effective deployment without the need for a hardware overhaul. We run AI-driven computer-vision models at the edge for low-latency alerts and leverage the cloud for comprehensive analytics and reporting. Our platform is engineered to solve core operational and security challenges for financial institutions, delivering a clear return on investment.

Key Use Cases Powered by Agrex.ai

Our modular approach allowed the bank to tackle its most pressing problems with precision. The solution was built on a foundation of cutting-edge AI and computer vision, tailored specifically for the financial sector’s unique demands.

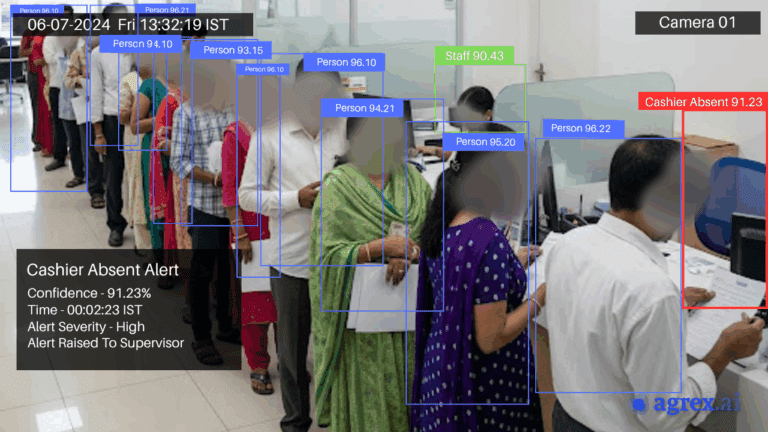

Operational Adherence & Procedural Compliance:

We automate the enforcement of critical operational SOPs. The system can detect if a teller’s station is left unattended for an extended period, or if a staff member is not following a mandated protocol, such as wearing a mask or uniform, thereby ensuring consistent service and security standards.

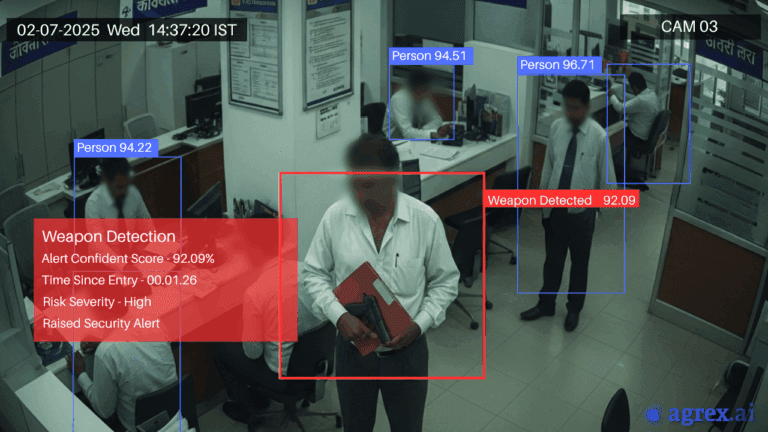

Physical Safety & Threat Detection:

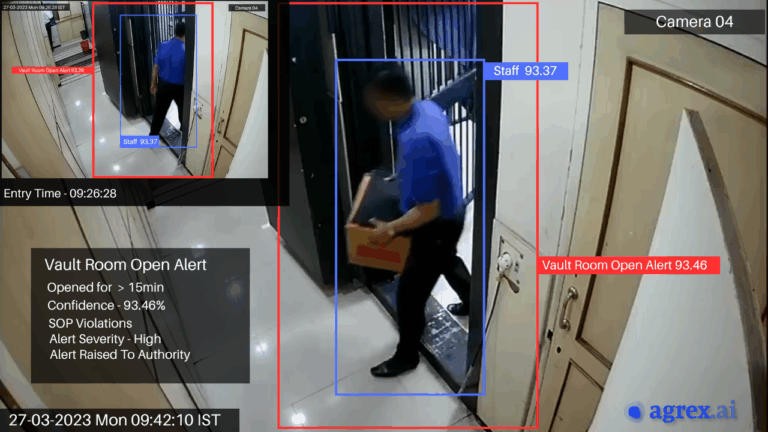

Our platform elevates staff and customer safety to a new level. It instantly identifies the presence of a weapon, detects an unauthorised person near the vault or in other restricted areas, and sends a silent, immediate alert to security personnel, enabling them to respond before a situation can escalate.

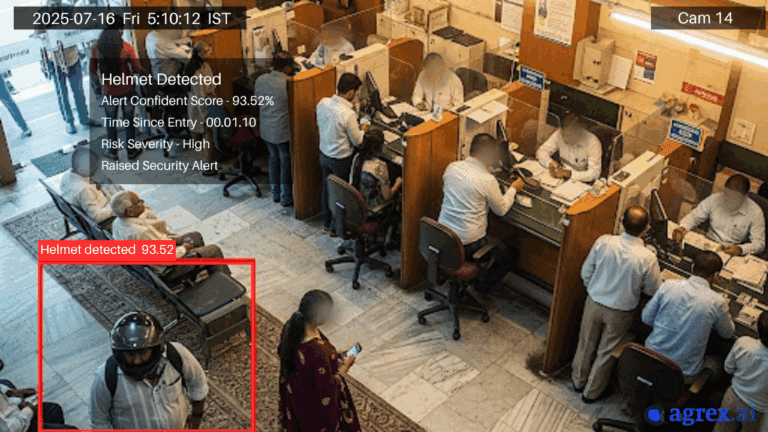

Unauthorised Entry & Access Control

We provided a vital layer of access control and deterrence. The system is trained to identify individuals with their faces obscured by a helmet or mask as they enter the bank or ATM lobby, sending an immediate alert to security personnel. This helps to prevent fraudulent or criminal activity from individuals attempting to conceal their identity.

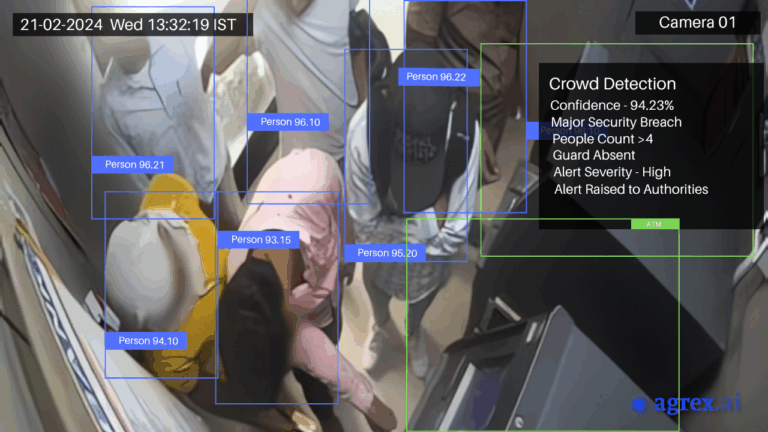

ATM & Lobby Safety:

This core module provides a critical first line of defense against physical threats. Our AI models are trained to detect suspicious activities like loitering for an extended, non-transactional period and the presence of unattended objects, enabling security teams to respond before a situation escalates.

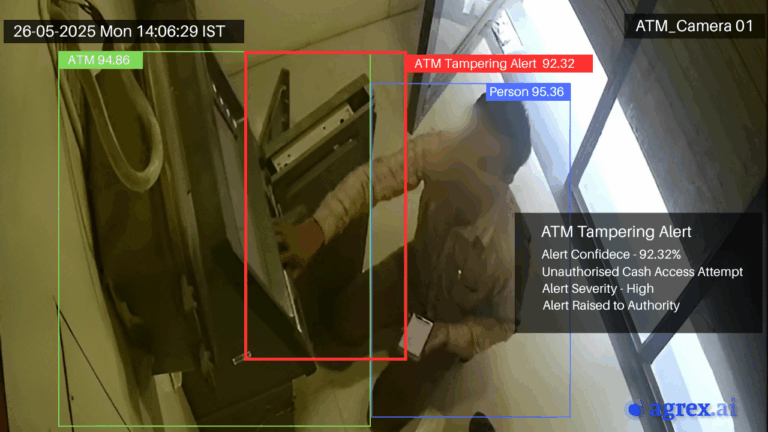

ATM Integrity Monitoring:

The system proactively protects the bank’s most vulnerable asset. It uses computer vision to spot subtle physical signs of someone tampering with the ATM machine and provides a real-time alert for potential fraud, such as the placement of a skimming device or a camera.

Queue & Wait-Time Analytics:

This module directly impacts customer satisfaction and operational efficiency. Cameras accurately count the number of customers in queues and estimate their wait time. When a pre-set threshold is exceeded, a real-time alert is sent to the branch manager’s mobile device, allowing them to proactively deploy additional staff and manage customer flow before frustration sets in.

See it live in your bank's footage

The Impact: A Proactive, Secure, and Efficient Future

By partnering with Agrex.ai, the bank achieved a dramatic and measurable transformation. The results were immediate and impactful, directly addressing the core challenges and delivering a clear return on investment.

Threats Averted

The bank saw a significant reduction in financial loss from physical fraud. Proactive alerts on loitering, tampering, and other suspicious activities created a first line of defense that simply did not exist before. Critically, the time from detection to response was reduced from hours to mere minutes, dramatically shrinking the window of opportunity for fraud and other security breaches.

Unprecedented Visibility

Branch managers and regional heads gained a level of operational visibility they had never had. They could remotely monitor SOP adherence and manage security risks with a level of detail and responsiveness previously impossible. The ability to get real-time data on the cleanliness of a branch or the timeliness of an opening enabled a new level of operational excellence.

Tangible ROI

The investment in Agrex.ai’s solution paid for itself by mitigating fraud, improving staff efficiency, and reducing customer churn associated with long waits and a poor branch experience. The on-time opening compliance rate improved to nearly 100%, eliminating a major source of customer complaints. The proactive queue management system reduced average customer wait times by over 45% during peak hours, significantly boosting customer satisfaction scores and freeing up managers to focus on strategic tasks rather than constant manual oversight.

Conclusion: A Proactive Future for Financial Institutions

This case study proves that the future of banking security and operations is intelligent, automated, and proactive. By moving beyond traditional surveillance, the bank transformed its physical assets into a network of intelligent, data-rich hubs. The value stack is clear and compelling: increased compliance and trust, a better customer experience, reduced risk and loss, and a new level of operational excellence.

For financial institutions looking to thrive in a competitive landscape, the lesson is clear: the physical branch must become as intelligent and efficient as its digital counterpart. By leveraging Agrex.ai’s video analytics platform, banks can not only protect their assets but also unlock new levels of operational excellence and deliver a superior customer experience, securing their place in the future of finance.

Ready to transform your physical locations into intelligent assets?

Frequently Asked Questions (FAQs) about Agrex.ai Banking Video Analytics

Our solution is an AI-driven platform that goes far beyond traditional surveillance. It analyzes video feeds from your existing cameras in real-time to provide actionable intelligence for both security and operations. While it is a powerful tool for preventing security threats like ATM fraud and unauthorized access, it also delivers data for optimizing customer experience, ensuring SOP compliance, and improving overall branch efficiency.

No. A core advantage of our solution is its seamless integration. The Agrex.ai platform is camera-agnostic, meaning it plugs directly into your current CCTV infrastructure, whether it’s IP, analog, or a mix of both. This approach minimizes upfront costs and allows for a rapid, non-disruptive deployment across your entire network.

We have a privacy-by-design approach. Our AI models analyze behaviors and objects, not personal identities. For example, our SOP compliance and helmet/mask detection features do not use facial recognition. All video data is processed and stored with a focus on strict access controls and robust encryption to ensure compliance with privacy regulations and protect sensitive information.

Absolutely. Our platform is modular and highly customizable. We work closely with your team to define and configure specific use cases that align with your unique Standard Operating Procedures (SOPs) and security protocols. This includes setting custom thresholds for queue times, defining restricted zones, and training our AI models to recognize your specific compliance requirements.

We view our clients as long-term partners. Our support includes comprehensive training for your staff on how to use the web console and mobile app. We also provide continuous monitoring and a dedicated support team to address any issues, ensuring the smooth and reliable operation of the system. Our goal is to ensure you achieve maximum value and a strong return on your investment.

We provide a holistic solution that blends security with operational intelligence. While other providers may offer a single security feature, Agrex.ai delivers a comprehensive suite of AI modules that address the full spectrum of challenges faced by modern banks. Our focus on real-time, proactive alerts, combined with our commitment to seamless integration and a data-driven approach, makes us a strategic asset, not just a security vendor.